We place the perception that larger funds tend to outperform their smaller counterparts under the lens to illuminate the hidden might of small or micro-VC funds.

The venture capital (VC) asset class has historically been positioned as being capable of producing outsized returns for investors—made more apparent after significant market downturns, such as the dotcom bust in 2001 and the global financial crisis of 2008. During these times, it’s the large, well-established VC funds that tend to cement their reputation for producing such results. This helps fuel the bias that fund size is correlated with performance. Yet, is the perception that bigger is always better rooted in empirical data? Or is it possible that small venture capital funds are unfairly overlooked, and their performance routinely underestimated?

Pivotal shifts in the economy have emerged over the past 18 months that threaten to destabilize the industry. In this article, we delve into these recent developments to extract a clearer understanding of the implications of fund size and its biases on investment outcomes.

How shifts in the economy have impacted the venture capital industry

In today’s challenging economic environment, two major shifts have had a tremendous impact on the VC landscape. The first is an aggressive swing in monetary policy. In a bid to counter post-pandemic inflation, there’s been a marked transition towards a hawkish monetary stance characterized by aggressive and consecutive interest rate hikes.

The second shift is broad-based valuation recalibrations because of shifting monetary policy. Public markets have undergone extensive enterprise valuation corrections; and private markets, such as venture capital, have slowly followed their public peers in painting a picture of caution and conservatism in the VC industry.

The effect of higher interest rates and lower valuations on investor behaviour

Higher interest rates along with the downtrend in valuations have had a cascading effect on investor behaviour, ushering in a complex new era for venture capitalists and institutional investors.

For VCs, the prevailing environment has necessitated a more cautious, tactical pivot. The opportunity cost of deploying capital into a net new company versus shielding an existing investment has never been higher. This has translated into an over-correction in reserves being channeled towards existing VC portfolios. The downside? A noticeably higher bar required for VCs to complete new deals, as well as a reticence towards initiating new deals. This has, in turn, decelerated fresh investments and created a cautious and ‘risk-off’ VC landscape.

On one hand, conservatism creates a vicious cycle. Overtly defensive positions across the industry require the individual investor to assume an ever more conservative posture to survive. On the other hand, from an aggregated perspective, conservatism will have the two positive effects: it will clean up the lower-quality companies that were previously funded, and will ensure capital is allocated to the very best companies.

For institutional investors (also called limited partners or LPs), their predicament is bifurcated. Firstly, the “denominator effect” looms large (when one portion of a portfolio, such as public holdings, decreases significantly in value and inadvertently increases the proportion of other types of investments in the portfolio that have not decreased in value.) As public holdings decrease in real time with market volatility, asset managers inadvertently skew heavily toward their private market allocations limiting their ability to increase their VC investments.

Secondly, those institutional investors that traditionally rely on returns from prior VC commitments find themselves in a quandary if the anticipated returns are elusive. It seems many LPs are seeing their VC portfolios as ‘paper rich and cash poor.’

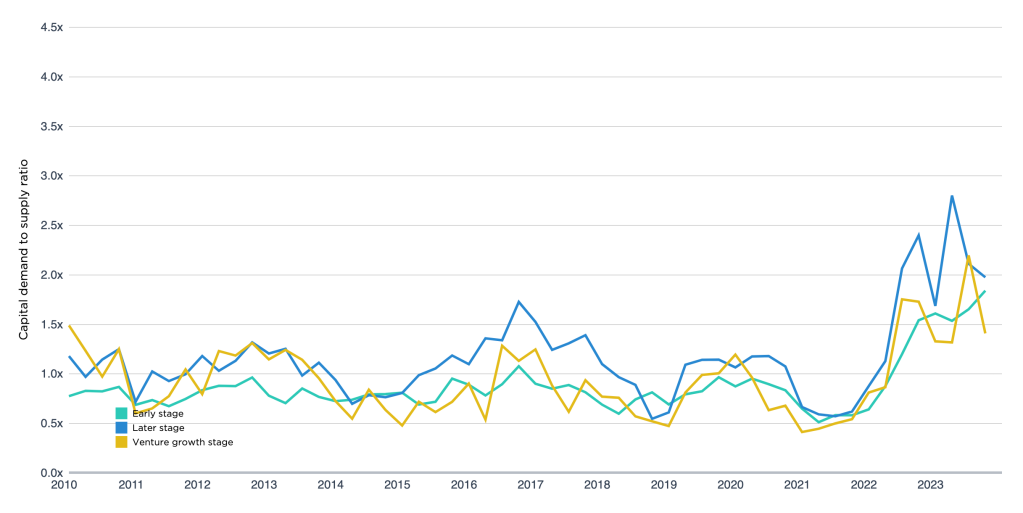

These two converging scenarios were palpably evident in 2022 and 2023 as the gulf between capital demand and supply widened, especially in ventures’ later stages.

A widening gap between capital demand and supply

According to the PitchBook VC Dealmaking Indicator chart (below), demand for capital has increased significantly relative to supply of capital. In the chart’s ‘Later stage’ and ‘Venture growth stage’, capital demand inordinately outstrips supply. (Note this is aggregated U.S. data, but the same dynamic would apply in the Canadian market, just on a much smaller scale.)

(Above) Source: PitchBook Data, Inc.

According to PitchBook, as of mid-2023, there was $271 billion in VC dry powder laying dormant in the U.S., ready to be deployed . Historically, institutional investors have leaned toward well-established VCs that commandeer sizable funds due to their long-term, multi-fund partnerships with LPs, while small VC funds, which lack the track record of established larger ones, are not as regarded. However, if dry powder is to be deployed towards venture capital—and larger funds are going to be continually raised—then the VC ecosystem will have to return even more money than it’s currently expected to. The conundrum lies in the fact that this established fund preference is not always rooted in empirical data, casting a spotlight on the significant influence of fund size on the investors’ expectation of return outcomes.

Put another way: if an LP has a choice between a large fund with a top-quartile track record and a smaller fund without one, statistically, which should it choose?

Breaking down the VC fund size bias

VC performance is often interpreted from the lens of fund size, which causes a distortion and elicits a bias. As a result of incentives and efficiencies, larger funds face challenges to realizing high returns that smaller funds do not.

Small funds may have more incentive to produce higher returns

The alignment of incentives between GP and LP varies drastically based on fund size. Managers of smaller funds who have invested substantial personal capital demonstrate an unwavering commitment to lucrative returns, while managers at the helm of colossal funds, buoyed by significant management fees, may exhibit a diminishing drive. This constitutes an almost incontrovertible structural benefit of managing a small VC fund. Furthermore, fund managers of established funds may, over time, raise larger subsequent funds and grow more risk averse. This can present a sub-optimal outcome for their LPs and, by virtue, manifests a bad omen for VC investing.

Small funds offer efficiency and specialization

Small or micro-VC funds are often lauded for their operational efficiencies. Their nimbleness facilitates swift investment decisions, enabling them to seize market opportunities that might elude their larger counterparts. As a VC fund scales, there’s a risk that overexpansion could potentially dilute the brand’s essence, compromising the quality of investments and partnerships, and thereby diminishing its competitive prowess. This gives rise to an intriguing proposition: might specialized, niche-focused managers, armed with in-depth sectoral insights, trump their more generalized peers in delivering value? In a market cycle (such as today’s), whereby capital is concentrated in only the best and brightest founders, VCs must ensure their thesis is one that not only resonates with their LPs, but also with startup founders who ultimately choose them.

Decoding fund performance metrics

An evaluation of fund performance requires an understanding of underlying nuances and distortions. Consider the following:

- The resilience of massive funds, which is characterized by their ability to weather sporadic downturns, grants them an undue advantage courtesy of survivorship bias.

- There is a disproportionate emphasis on brand and reputation as determinants of fund size.

The quantitative illustrations below speak to the impact of fund size on performance and beg the question: Is it plausible that large funds thrive, not because of, but in spite of their sheer magnitude?

The impact of size on fund unit economics

To illustrate the impact that fund size holds on underlying fund economics, consider two scenarios:

Scenario 1: $50 million fund

A $50 million fund deploys their strategy and expects their terminal exit ownership (accounting for dilution) to be around 5%.

To return 1.0x the fund requires a portfolio exit value of $1 billion

$1 billion x 5% exit ownership = $50 million (1.0x fund)

Scenario 2: $250 million fund

A general partner (GP) raises a $250 million fund with a larger aggregate portfolio and expects their terminal exit ownership to be 10%.

To return 1.0x the fund, 10% exit ownership requires an exit value of $2.5 billion

$2.5 billion x 10% exit ownership = $250 million (1.0x fund)

The example in scenario two requires multiples greater than the $1 billion exit required in scenario one. Therefore, it indicates a larger fund requires a larger exit value to produce fund-level returns. It’s equally important to note that the pool of companies capable of achieving an exit of such scale would be a rather small opportunity set.

This reality is further emphasized with the aggregated portfolio enterprise values (EV) required to return 3.0x a fund: $7.5 billion at 10% exit ownership.

In scenario one, the $50 million fund at 5% exit ownership would require $3 billion in exited enterprise value to reach 3.0x ($3 billion x 5% exit ownership = $150 million or 3.0x fund)

This exemplifies why smaller funds, if deployed correctly, have an outsized probability of returning a healthier multiple of their fund, in contrast to their mega-fund peers.

- When compared with larger funds, small VCs demonstrate more feasible mechanics in the quest for fund returns, as they show a higher mathematical propensity to deliver MOIC (multiple of invested capital), even with moderately-sized ownership stakes. It’s also an indication that–unlike alternative asset classes such as private equity and real estate–venture capital does not scale as effectively.

- Large funds are structurally predisposed to invest in more companies and/or invest more dollars in each company. The former dilutes returns and reduces the amount of time an investor can dedicate to supporting each company. The latter inevitably pushes a fund’s dollar-weighted capital into larger, later stage rounds at higher pre-money valuations. Conversely, small VCs are in a better position to participate in smaller, more prudently sized rounds and are therefore uniquely suited to potentially generate consistently strong returns.

The implications of management fees and carried interest

The standard VC fee model is closely intertwined and manifests deep rooted implications for fund management incentives. The standard fund management fee and carried interest structure of a VC fund is two and twenty–two per cent management fee and 20 per cent carried interest. Pragmatically, management fees are essentially a non-recourse loan against carried interest, as the GP does not actually earn carried interest until all called capital is returned to investors. However, in practice, the GP calls capital from the fund’s LPs to pay for operational costs within the year.

To illustrate the implications of this structure, consider two scenarios (using a two and twenty fund management fee and carried interest structure.)

Scenario 1: $100 million fund

A GP has returned 4.0x the capital on a $100 million fund. Over the fund term, the GP earned $20 million in fees ($100 million x 20%) plus $60 million in carried interest ($300 million x 20%).

This results in aggregated GP proceeds of $80 million.

Scenario 2: $500 million fund

A GP raised $500 million and returned 1.0x the fund. The GP has not earned any carried interest (there were no profits generated) but earned $100 million in management fees over the fund term ($500 million x 20%). This results in aggregated GP proceeds of $100 million.

The implication?

The GP that returns just 1.0x on their $500 million fund will earn $20 million more in profits than the GP that returns 4.0x on their $100 million fund (which as most would agree, is a result only the top decile of fund managers is able to produce.)

In scenario two, the GP has less incentive to generate true economic value to their LPs because management fees are significant enough to compensate in paucity of carried interest. For large VCs, the break-even point beyond which carried interest is earned is higher than that of smaller VCs, and the incentive of carried interest is delicately diminished from a GP’s perspective. This has significant implications for the alignment of interest between GPs and their LPs.

Small VC funds deserve more than a second look

Small VC funds appear poised to optimize fund performance, incentives, and management efficiencies. However, their journey is not without hurdles. Challenges such as potential dilution during extended private tenures for startups, coupled with the vagaries of market perceptions and data anomalies, pepper their path. As the VC tapestry evolves, it is imperative for all stakeholders to remain nimble, informed, and strategic.

RBCx offers support to startups in all stages of growth, backing some of Canada’s most daring tech companies and idea generators. We turn our experience, networks, and capital into your competitive advantage to help you scale and make a meaningful impact on the world. Speak with an RBCx Advisor to learn more about how we can help your business grow.

References

BDC. (2023, May). Canada’s Venture Capital Landscape. [industry report]. Retrieved from BDC website.

RELATED TOPICS

Other articles you may be interested in